Remember the initial excitement surrounding 5G? We were promised a hyper-connected future with blazing-fast speeds and a world brimming with smart devices. We're now in that era. Yet, the reality often feels like a gradual rollout, with those promised speeds not always consistently available.

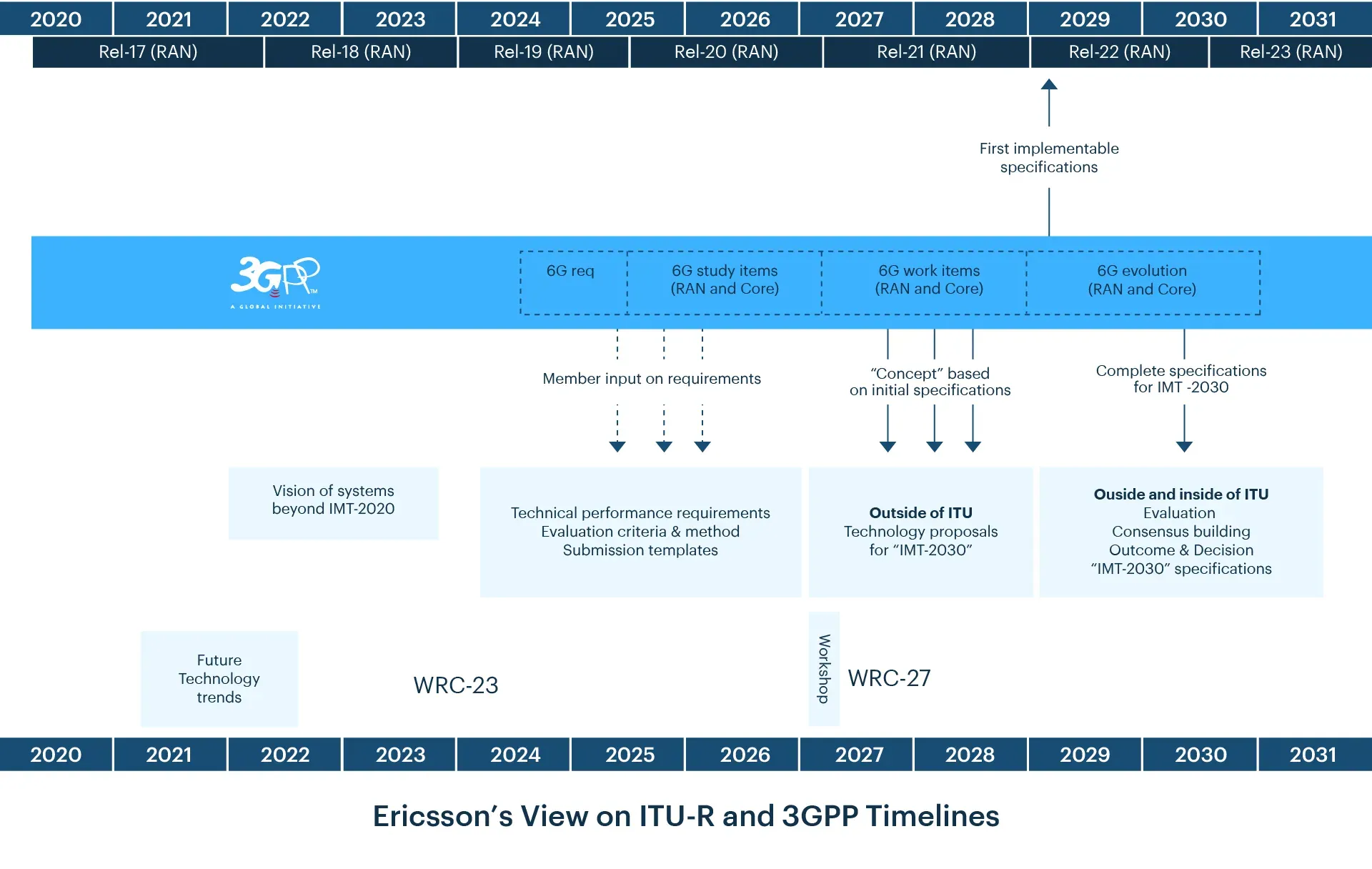

While we're still assessing 5G's true impact and grappling with its deployment complexities, the cellular industry is already looking ahead to 6G. This isn't premature; the development of networks, policies, and ecosystems for a new generation takes years. The standardization process for 6G is already underway, with organizations like 3GPP outlining timelines that point towards commercial deployment around 2030.

Major players in the industry, like Nokia and Ericsson, have been conducting early research into 6G for several years, recognizing the need to be well ahead of the curve to meet the demands of the next decade.

This proactive approach is crucial because 6G isn't just about faster speeds; it's about addressing evolving societal needs, supporting new and disruptive use cases, and tackling the limitations that 5G might face in the coming years. Let's examine the current state of 5G and the early discussions around 6G to understand what the future might hold.

Decoding the Present: Expectations vs. Reality for 5G

When 5G debuted, it promised more than just faster downloads-it envisioned ultra-low latency (around 1 ms) and peak speeds of nearly 10 Gbps, enabling breakthroughs such as remote surgeries and autonomous vehicles. These gains rely on multiple frequency bands: low (600–900 MHz) for wide coverage and high (24–47 GHz+) for dense, high-speed zones.

5G deployment follows two architectures-Non-Standalone (NSA) and Standalone (SA):

5G NSA – The Bridge Phase

NSA leverages the new 5G New Radio (NR) alongside the existing 4G LTE core. The 4G network handles control signals, while 5G NR boosts data rates. This hybrid setup enables quicker rollouts and lower costs, but it limits features such as true ultra-low latency and network slicing due to its dependence on 4G.

5G SA – The Full 5G Experience

SA runs on a dedicated 5G core and Radio Access Network (RAN), unlocking all 5G capabilities: lower latency, better spectral efficiency, enhanced security, and faster service deployment. It’s the foundation for advanced use cases, such as end-to-end network slicing and cloud-native operations. For a deeper dive, see our detailed blog on 5G Technology & its impact.

The Current State of 5G

Across many markets, users of 5G networks are seeing median download speeds in the hundreds of Mbps rather than gigabit-rates. For example, in Q4 2024, the United States recorded a median 5G Standalone speed of ~388.4 Mbps, up from ~305.4 Mbps the previous year, according to 5G Americas. At the same time, broader Standalone (SA) adoption and rural coverage expansion continue to require significant infrastructure investment and operational readiness, which naturally slows full next-generation 5G rollouts.

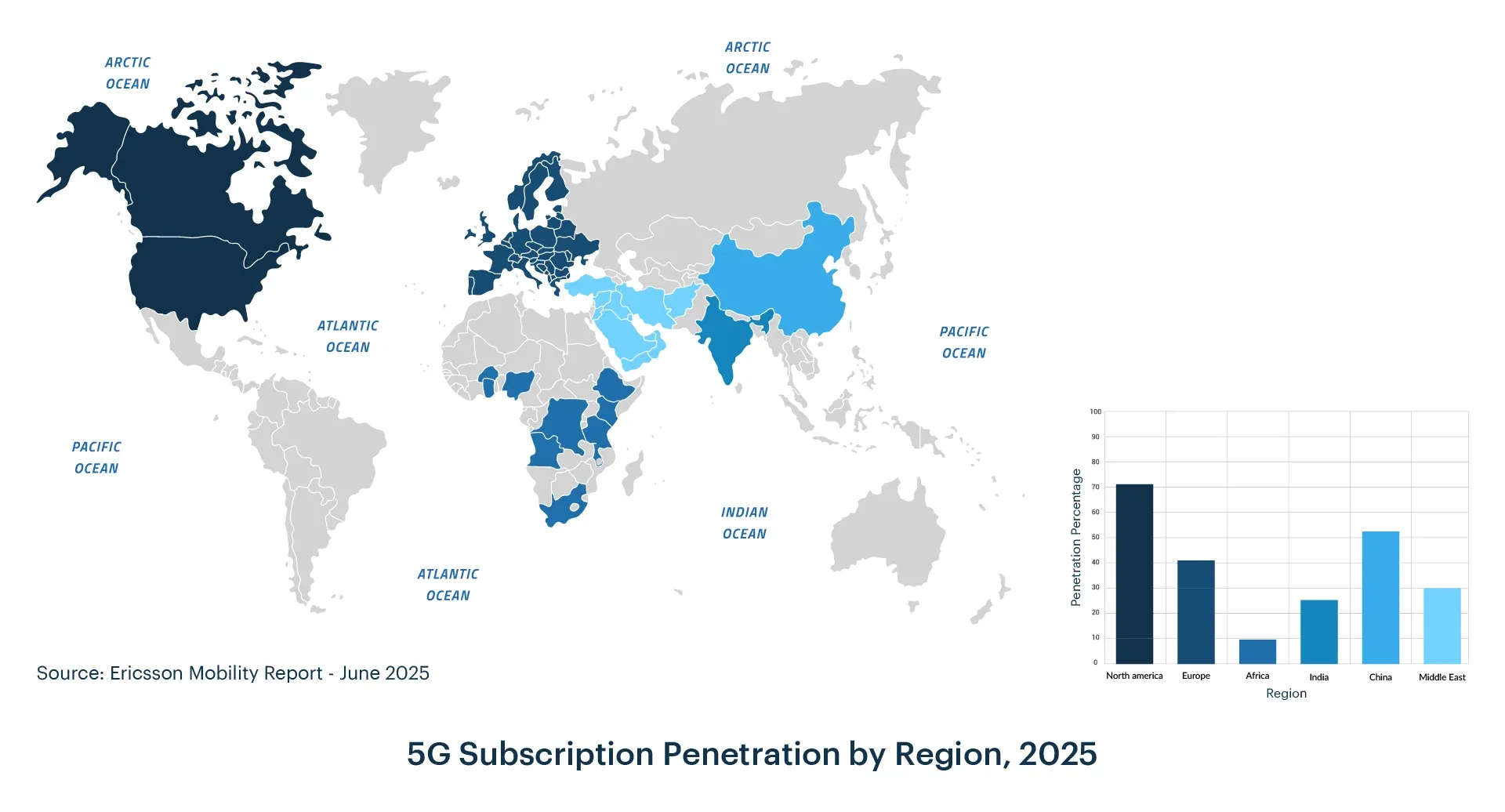

5G Adoption Across Geographies

5G adoption is progressing unevenly across regions, shaped largely by government policies, market dynamics, and infrastructure readiness.

In the US, telecom operators have invested billions in upgrading networks to stay competitive, driven by strong demand and fear of customer churn. The FCC has prioritized high-band spectrum auctions, pushing operators to focus on urban rollouts, with support from state and federal funding helping to offset infrastructure costs. As a result, 5G is well established in the US, with certified modules and growing demand expected to drive mass rollout by the end of the year.

In contrast, Europe has taken a more cautious approach. Many regions are still operating on LPWAN and NB-IoT, with full-scale 5G deployment progressing at a slow pace. The focus is gradually shifting from 5G NSA (which relies on existing 4G infrastructure) to 5G SA, but adoption remains limited-Vodafone's rollout in Germany is one of the few notable examples. Coverage is often restricted to major cities, with weaker service in between.

Meanwhile, the APAC region is rapidly catching up, with countries like China, Japan, Korea, and India leading the charge. In China, significant government backing and tech giants like Huawei and ZTE are accelerating deployment, while manufacturers are designing devices that can fall back on 4G but are ready for 5G-ensuring future compatibility as networks expand.

Advancing 5G Adoption: Understanding the Challenges and the Progress Being Made

While 5G continues to generate excitement for its potential in speed, latency, and new digital services, its global rollout has naturally encountered some practical hurdles. Much of this stems from the nature of the technology itself. Unlike 4G, 5G-especially in higher frequency bands-depends on a denser network of base stations, closer site spacing, and upgraded backhaul. These requirements introduce additional planning, investment, and timelines, particularly in regions where network build-out has historically been slower.

A general industry observation is that rural deployments face unique constraints: wider geographic spread, lower immediate ROI for operators, and the need for synchronized upgrades in power and fiber infrastructure. Tariff structures and policy frameworks are also still evolving in many markets, influencing user adoption and ecosystem maturity. Concerns around electromagnetic compliance and public clarity on regulations further contribute to a measured rollout approach.

On the operator side, the shift from early Non-Standalone (NSA) deployments toward full Standalone (SA) networks represents a significant multi-year infrastructure journey. SA unlocks the real advantages of 5G-network slicing, deterministic QoS, low-latency uplinks-but requires new core networks, RAN upgrades, and widespread small-cell layers to fully deliver its capabilities.

Device and chipset dynamics add another layer. As noted by Satyajit Sinha, Principal Analyst at IoT Analytics, early 5G modules required advanced antenna design, thicker R&D investment, and initially came at a premium price point. Combined with pandemic-era supply chain slowdowns, costs remained high for longer than the industry anticipated. For IoT deployments-often scaling into tens or hundreds of thousands-module affordability and certification complexity significantly influenced adoption cycles. As a result, 5G initially gained traction in select verticals like fixed wireless access and certain automotive applications, where ROI and performance requirements were clearer.

Here’s a concise look at the challenges shaping 5G rollout and the steps the industry is taking to overcome them:

| Challenge Area | Impact on Adoption | How It’s Progressing |

|---|---|---|

| Infrastructure build-out & densification | High-band 5G needs more sites and stronger backhaul; rural economies slow deployment. | Targeted small-cell rollouts, neutral-host systems, phased SA upgrades, and subsidy-backed rural programs. |

| Spectrum policy, pricing & tariffs | Licensing costs, fragmented bands, and evolving tariff models increase TCO and slow uptake. | New mid-band releases, enterprise spectrum options, simpler consumer plans, and clearer EMF compliance frameworks. |

| Monetization & ROI | Early consumer 5G services offered limited differentiation, making returns slower. | Private 5G, edge deployments, tiered QoS models, and outcome-based enterprise contracts are gaining traction. |

| Shift to 5G Standalone (SA) | NSA limits slicing, low-latency uplink, and industrial-grade QoS. | SA cores launching in phases; early trials in media, events, logistics, and industrial automation. |

| Device/module economics & certification | Higher module costs, complex SKUs, and lengthy certification slow IoT scaling. | RedCap chipsets, pre-certified designs, multi-region band profiles, and more streamlined carrier certification. |

Matching Connectivity to the Use Case: Where 5G Excels

5G brings clear advantages-higher throughput, support for massive real-time data, and power efficiency that increasingly rivals 4G. But like any connectivity technology, its value depends on the use case. Some applications truly benefit from 5G’s capabilities, while others operate more efficiently on lighter, lower-cost technologies.

On the high-performance end, sectors such as industrial automation, V2X communication, premium automotive, and real-time media workflows are natural beneficiaries. These environments demand low latency, fast uplink, deterministic performance, and the ability to process or transmit large volumes of sensor or system data in real time. As Surendar Kannan, VP-APAC Sales, Cavli Wireless, notes, “V2X, where vehicles communicate with each other, requires the kind of instant data transfer only 5G can deliver. For now, though, 4G remains sufficient for most automotive connectivity needs, at least in Asia. Real 5G use cases in automotive will come-but we’re still 4–5 years away.”

Gopinath Krishnamurthy, VP - EMEA Sales, Cavli Wireless, states that in segments like luxury automotive, adoption is accelerating even faster. “The incremental cost of a 5G module is negligible in a vehicle priced at the premium end of the market, which is why many new models are integrating 5G connectivity ahead of consumer demand.”

Fixed Wireless Access (FWA) is another area where 5G is already proving transformational. , As Satyajit Sinha, Principal Analyst at IoT Analytics, adds “By leveraging 5G’s high speeds and low latency, operators are delivering last-mile connectivity to homes and businesses faster than ever before and at a lower cost through Fixed Wireless Access. Telcos and module manufacturers have worked closely together to push FWA as a compelling alternative to traditional fiber or broadband, especially across markets like China, India, Europe, and North America.”

At the same time, many mainstream IoT deployments simply do not require the capabilities-or cost structure-of 5G. In domains such as agriculture, metering, and asset tracking, devices often generate minimal data from one or two sensors and operate on long duty cycles. These applications prioritize affordability, power efficiency, and wide coverage over high bandwidth. In such scenarios, technologies like LTE Cat 1bis offer an ideal balance: global footprint, low power modes, simpler certification, and significantly lower module and deployment costs.

Beyond Connectivity: The Economic Impact of 5G

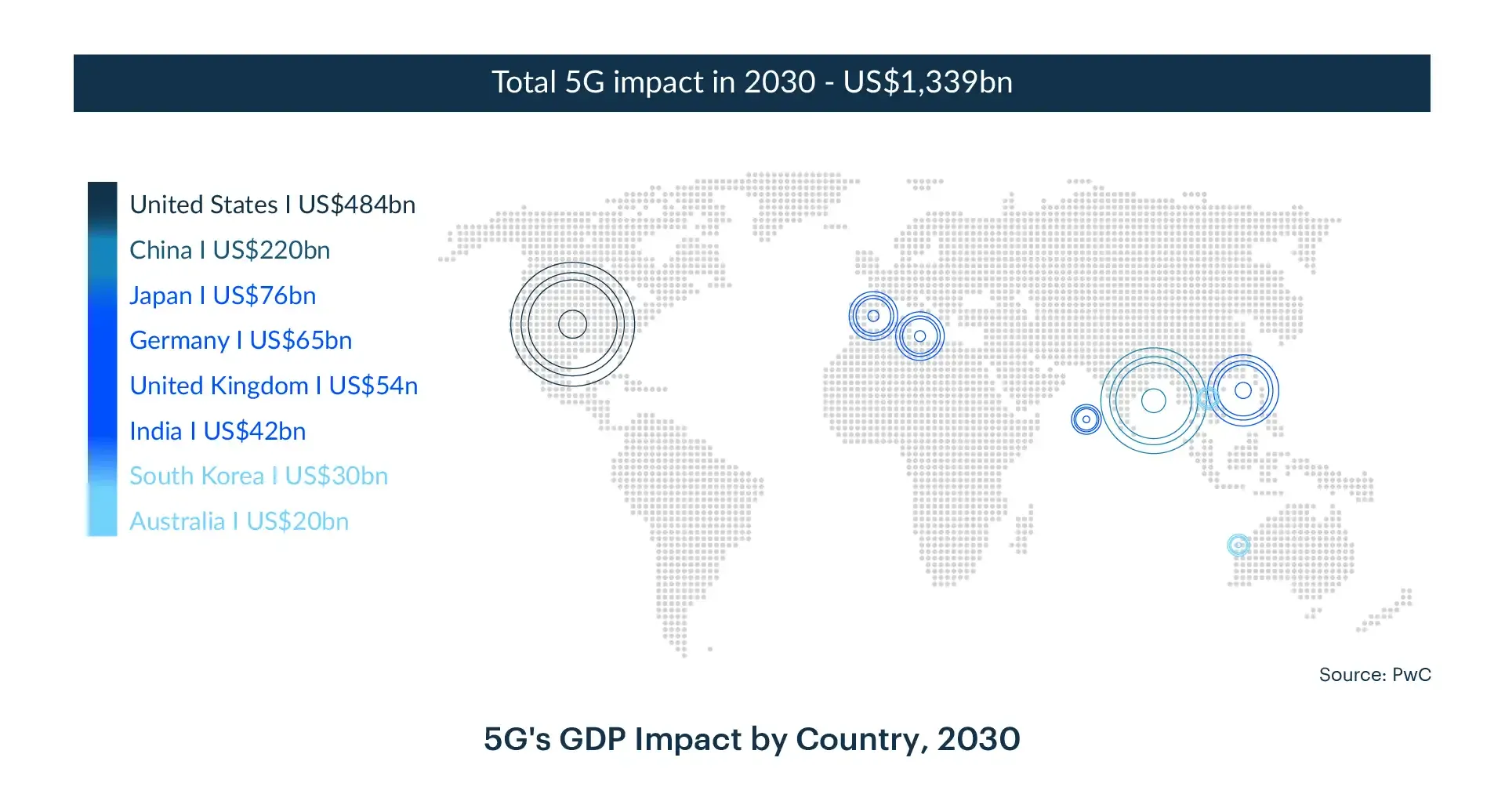

5G’s Global GDP Lift - Where the Value Concentrates

PwC projects about US$1.339T in 5G-driven GDP impact by 2030. The largest shares come from the United States (~US$484B) and China (~US$220B), followed by Japan (~US$76B), Germany (~US$65B), the UK (~US$54B), India (~US$42B), South Korea (~US$30B), and Australia (~US$20B). Read simply, value clusters in markets with early spectrum availability, enterprise adoption, and strong device ecosystems-signals that our near-term opportunities skew toward North America and East Asia, with Europe and India accelerating as standalone 5G and industry use cases mature.

As a complement to adoption data, we can anchor the economic weight by sector with PwC’s 2030 view which quantifies 5G’s GDP impact by industry-led by healthcare (~US$530B) and smart utilities (~US$330B), followed by consumer & media (~US$254B), manufacturing (~US$134B), and financial services (~US$85B). This framing helps us prioritize where 5G value is most likely to materialize first and where our solution playbooks should be most aggressive.

Engines of 5G Scale: The IoT Technologies Driving Real Outcomes

As the industry shifts toward more efficient and scalable connectivity models, three core technologies- 5G RedCap, Massive Multiple Input, Multiple Output (MIMO), and Network Slicing-are emerging as the foundation for the next era of 5G deployments.

5G RedCap: Bringing 5G to Fleet-Scale IoT

RedCap (Reduced Capability) is a streamlined version of 5G New Radio (NR) that addresses the challenge of making 5G suitable for fleet-scale IoT. It offers near-5G-grade performance with reduced complexity and cost-key for mass deployment. RedCap retains the essential benefits of 5G NR, such as better uplink performance and improved spectral efficiency, which are vital for devices that need to send regular sensor data or real-time camera feeds.

This balance of bandwidth and affordability positions it as the natural evolution path from LTE, allowing enterprises to onboard thousands of devices onto modern networks without the overhead of full 5G NR.

Ultimately, RedCap propels 5G adoption in industrial settings by ensuring connections behave consistently and reliably, even in dense operational environments or at the edges of coverage, making it well-suited for industrial telemetry and smart logistics. Cavli’s CQM220 reflects this direction to offer peak rates of ~220 Mbps downlink and ~120 Mbps uplink, in-built dual band GNSS, and multiple form factors (LGA and M.2), making it well-suited for industrial telemetry, smart logistics, camera-based sensing, and other asset-intensive operations.

Massive MIMO: Unlocking Hyper-Capacity and Coverage

Massive MIMO (Multiple Input, Multiple Output) is a fundamental RAN technology that uses large arrays of antennas (often 64T64R or more) at the base station to serve multiple users on the same frequency band simultaneously. This is a critical enabler because it drastically improves spectral efficiency-the amount of data transmitted over a fixed portion of spectrum-without needing to acquire new frequencies.

By employing 3D beamforming that steers radio beams not just horizontally but also vertically, Massive MIMO precisely focuses radio energy toward devices, improving signal strength and range while reducing interference. This capability is essential for delivering the gigabit-speed downloads and massive capacity expected from 5G in dense urban areas, directly raising the performance bar for the eMBB (enhanced Mobile Broadband) services.

Ultimately, by improving the user experience and helping operators meet the growing demand for data traffic, Massive MIMO is accelerating 5G adoption among both consumers and enterprises that require sustained, high-speed connectivity.

Network Slicing: Tailoring the Network for Industry Verticals

Network slicing is a 5G Standalone capability that lets operators create multiple logical networks (slices) on a common infrastructure, each engineered with specific QoS policies and isolation for enterprise use cases. A plant-automation slice, for example, can combine URLLC features, edge compute, and TSN to deliver bounded-latency, high-reliability control loops, while a media slice can be tuned for high capacity.

By enabling enforceable QoS and service differentiation, slicing unlocks new SLA-based monetization models, propelling 5G’s shift from consumer broadband to the backbone of mission-critical industrial digitalization.

Transitioning from 5G to 6G: A Measured Evolution

6G is positioned to advance the foundations laid by 5G, with projected terabit-per-second peak speeds, near-instant latency, and the ability to support 10 million connected devices per square kilometer. While the technical ambitions are significant, the transition is unfolding gradually. Standardization efforts began in 2023, with the first commercial deployments expected around 2030. Many organizations are approaching 6G cautiously, prioritizing market realities over aggressive forecasts. As industry analyst Anthony Veri emphasizes, “market-driven demands must guide the transition rather than assumptions about future consumer behavior.”

Several countries, including South Korea, Japan, China, and India, have already initiated early 6G trials, reflecting a global interest in advancing beyond 5G. Research firms anticipate a multi-year coexistence period where both technologies operate in parallel. As Gopinath Krishnamurthy notes, “6G adoption will unfold sequentially, starting with innovators and pioneers like Tesla and Meta, with widespread shifts expected in the early 2030s. Full-scale adoption in regions like the US and Europe is expected between 2029-2031, influenced by pricing and market readiness. There will be a more widespread shift to 6G by the early 2030s. Initial market uptake will take several years post-standardization.”

Sustainability and efficiency are emerging as central themes in early 6G thinking. Consultant at SensorNex Consulting, Andrew Leki, highlights the opportunity to improve network operational efficiency through AI-driven optimization and green technologies. “Telecom operators are investing in cost-efficient solutions like software-defined networking (SDN) and massive MIMO technologies, facilitating a smooth evolution from existing 5G infrastructure to 6G with minimal disruption. These comprehensive strategies ensure that 6G deployment remains economically viable, secure, and environmentally sustainable,” he adds.

Overall, the industry’s near-term priority is clear - continue maturing 5G deployments while preparing a realistic pathway to 6G. The evolution will be incremental, guided by standardization progress, market readiness, cost considerations, and lessons learned from 5G’s adoption curve.